It is important to consider what questions you should ask an insurance adjuster before you meet with them; this way, you do not forget to bring up something important. You can ask an attorney to accompany you to this meeting if you wish. While the questions you ask will inevitably depend on your precise situation, examples of good topics to cover include:

- What types of damage your policy covers

- How much time they will need to process your claim

- What types of evidence they need from you—and when they need to have it

- What steps you must take if you disagree with their decision

When to Speak With an Insurance Adjuster

An insurance adjuster will come to speak with you after you have filed a claim for injuries or damages caused by an accident or natural disaster. It is their job to:

- Assess the damage

- Speak with you about what happened

- Collect any evidence you have concerning what happened

- Decide whether to approve your claim

You will want to plan carefully for this meeting. This may involve:

- Informing your lawyer of the meeting and asking them to join you

- Speaking to your lawyer about your rights in this situation

- Preparing any relevant paperwork that the insurance adjuster may want to see

- Planning out questions ahead of time

- Keeping a pen and paper handy so you can take notes during the encounter

If your injuries were caused by another party—for instance, if someone else hit your car—you can expect a visit from insurance adjusters from both your own insurer and the liable party.

Below are examples of the type of questions you may want to ask the insurance adjusters. An attorney from Bader Law Injury Lawyers can help you come up with a more specific list that fits your situation.

For a free legal consultation, call (404) 888-8888

Question #1: What does My Policy Cover?

Georgia requires certain types of people to carry a minimum amount of insurance before they can go about their business. For example, O.C.G.A. § 33-7-11 states that all drivers must carry car insurance to cover both bodily injuries and property damage.

Georgia is a fault state. This means, that if the accident was not your fault, you can seek compensation from the at-fault party’s insurer rather than your own. It is important to talk to the insurance adjuster about not just how much the policy covers, but under what circumstances you can receive a payment from them.

Question #2: How Long does the Claims Process Take?

Some cases may take longer to complete than others. Complicating factors could include:

- The involvement of three or more parties

- Any confusion about the cause of the event

- Extensive injuries or property damage

To keep insurance companies from dragging cases out, they usually have a restricted amount of time in which to consider and respond to each claim. You can ask both your lawyer and the insurance adjuster about what this time limit is.

If you do not hear back from the insurer within the specified time, you can try to contact the insurer yourself or have your lawyer do so.

Complete a Free Case Evaluation form now

Question #3: What Evidence do You Need?

It is the insurance adjuster’s job to learn everything they can about your claim. To do this, they will talk to you about what happened, including your role in the event in question. Remember that you have a right to:

- Refuse to give a recorded statement

- Have your lawyer with you during the interview

- Ask for clarification before answering any question

They may also ask for any relevant paperwork that could help them in deciding your claim. When you ask what they need, they may request items such as:

- Bills from a mechanic or anyone else you hired to repair the damage

- Medical bills incurred due to accident injuries

- Receipts from items you would not have needed to purchase or rent if not for the accident

Click to contact our personal injury lawyers today

Question #4: What if I Disagree With the Decision?

That the adjuster may deny your claim, in part or in full, is unfortunately a very real possibility. They may cite many reasons for refusing to pay damages, including:

- A lack of evidence

- Untimely filing

- The damage done is not covered by your policy

- The damage was not caused by a covered event

A denied claim does not have to be the end of the road. Ask the adjuster what you can do if you disagree with their decision, including how much time you have to take action. A lawyer from our firm can also help you to better understand what steps to take following a denial.

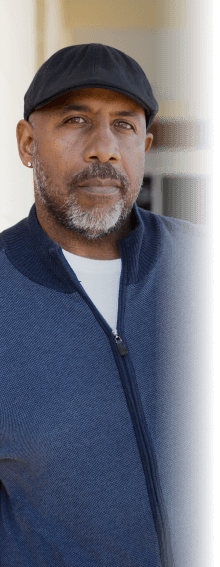

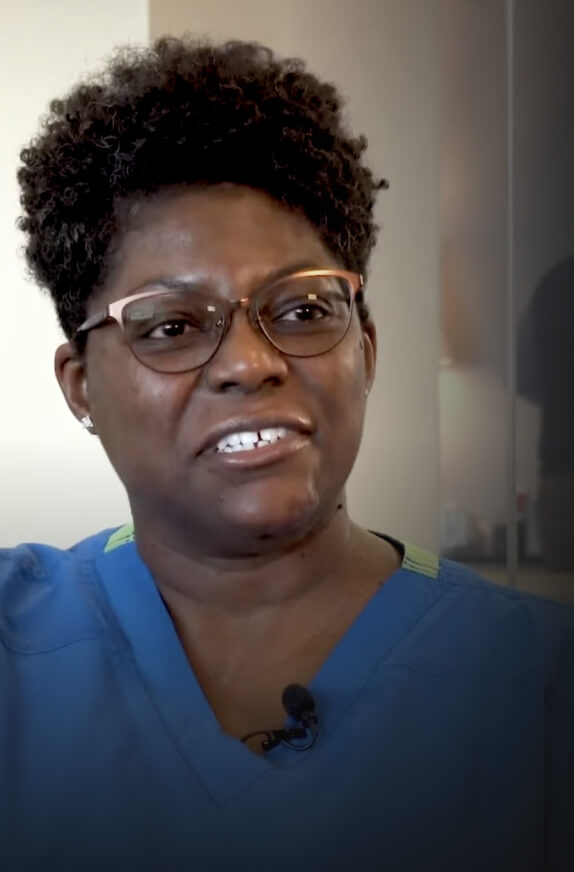

We Can Deal With the Insurance Adjuster

Bader Law Injury Lawyers understands that you are under a lot of stress. We want to help you by identifying what questions you should ask an insurance adjuster. We can even speak to the insurance adjuster on your behalf. Call us today and get a free case review from a member of our team.

Call or text (404) 888-8888 or complete a Free Case Evaluation form