If you are dealing with a workers’ compensation claim in Georgia, you may eventually hear the term “compromise and release.” A compromise and release in a workers’ compensation case is a final, lump-sum settlement that permanently closes the claim.

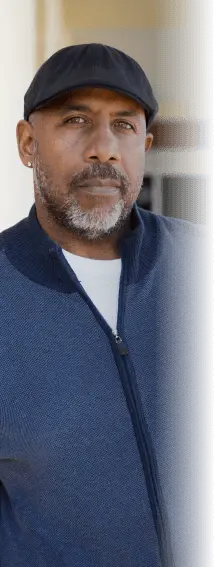

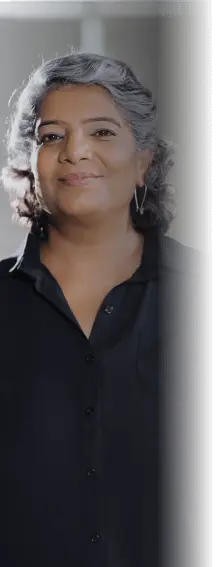

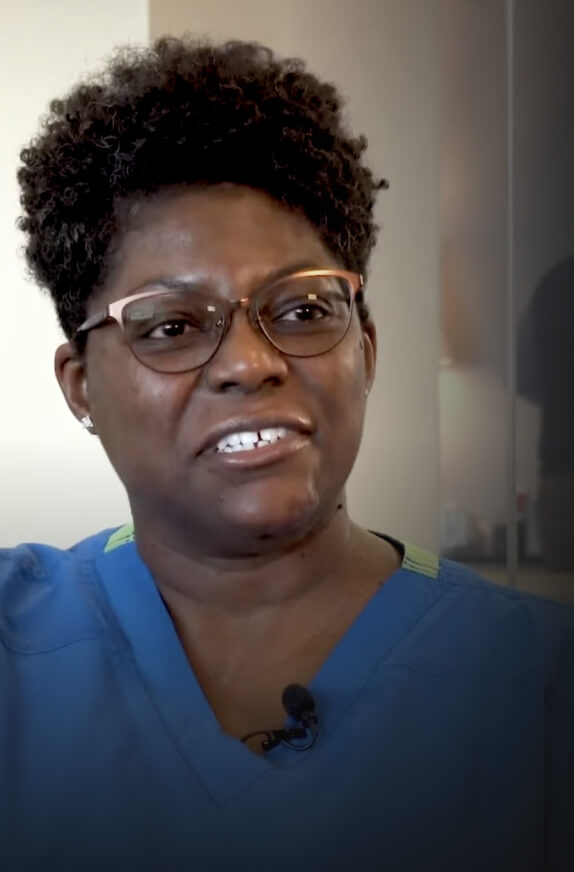

Settlement offers can be appealing, but a compromise and release isn’t always the best option. An Atlanta workers’ compensation lawyer can review your case and advise you on the best way to maximize your benefits.

What Does Compromise and Release Mean in Workers’ Comp Claims?

In a Georgia workers’ compensation case, a compromise and release is a type of settlement where both sides agree to close the claim in exchange for

a specific payment amount.

- Compromise: Both sides give something up. You typically accept less than the maximum you might receive over time, while the employer or insurer pays more than they want to pay immediately.

- Release: You permanently give up the right to future workers’ compensation benefits related to that injury.

Once approved by the Georgia State Board of Workers’ Compensation, the claim is closed. This means no more weekly checks, authorized medical treatment, or reopening the case later if your condition worsens.

For a free legal consultation, call (404) 888-8888

How Compromise and Release Works Under Georgia Workers’ Comp Law

Georgia allows compromise and release settlements, but they must meet specific requirements. First, both parties negotiate the settlement amount. This includes consideration of:

- Past benefits already paid

- Future wage-loss benefits you may be entitled to

- Future medical treatment costs

- The likelihood of ongoing disability

Once an agreement is reached, the settlement paperwork is submitted to the Georgia State Board of Workers’ Compensation. The Board reviews it to ensure it appears fair and that you understand what rights you are giving up. If approved, the insurer issues payment, and the claim is officially closed.

What Benefits Are You Giving Up With a Compromise and Release?

This is the part many injured workers underestimate. A compromise and release settlement in Georgia typically ends all workers’ comp benefits related to the injury, including:

- Weekly income benefits: Temporary total, temporary partial, or permanent partial disability payments stop permanently.

- Medical treatment: Workers’ comp no longer pays for doctor visits, surgery, prescriptions, therapy, or future care.

- Future claims: You cannot reopen the case, even if your condition gets worse or new complications arise.

Once the release is signed and approved, the insurer is done with the claim for good.

Complete a Free Case Evaluation form now

Why Some Georgia Workers Choose Compromise and Release

Despite the risks, compromise and release settlements are common in Georgia workers’ comp cases. For some people, they make sense. Common reasons people accept this type of settlement include:

- Immediate financial needs: A lump-sum payment can help cover bills, debts, or major expenses.

- Desire for closure: Ongoing claims can be stressful, slow, and frustrating.

- Uncertain future benefits: If weekly checks may end soon anyway, a settlement can provide guaranteed income.

- Medical treatment plans: Some workers prefer to manage their own medical care rather than deal with workers’ comp restrictions.

Click to contact our personal injury lawyers today

When Compromise and Release May Be a Bad Idea

Accepting a compromise and release is not always a smart move. In fact, for some injured workers in Georgia, it can be a costly mistake. Situations where you should exercise caution include:

- Ongoing or worsening medical conditions: If future surgery or long-term care is likely, closing medical benefits can leave you paying out of pocket.

- Unclear disability status: If it’s not yet known whether your injury will cause permanent limitations, settling early can undervalue the claim.

- Young workers: Younger workers may face decades of medical or income impact that a one-time payment doesn’t adequately cover.

- Pressure from insurers: Early settlement offers are often designed to save the insurer money, not protect your future.

How Settlement Amounts Are Calculated in Georgia

There’s no fixed formula for compromise and release settlements in Georgia. Instead, amounts are based on a combination of legal and practical factors, including:

- Average weekly wage: This determines how much your weekly income benefits are worth.

- Type and severity of injury: More serious injuries usually justify higher settlements.

- Maximum benefit duration: Georgia caps how long certain benefits can be paid.

- Medical prognosis: Expected future treatment costs matter a lot.

Does a Compromise and Release Affect Other Benefits?

Yes, and this reality is often overlooked. A compromise and release settlement can affect:

- Medicare eligibility: Future medical costs may need to be allocated properly to avoid Medicare issues later.

- Social Security Disability benefits: Large lump-sum settlements can temporarily reduce SSDI payments if not structured correctly.

- Private health insurance: Once workers’ comp medical coverage ends, your health insurance becomes responsible (if it covers the treatment at all).

Failing to plan for these consequences can turn a settlement into a financial problem instead of a solution.

Should You Accept a Compromise and Release in Georgia?

A compromise and release can be the right choice if the amount fairly reflects your injury, future needs, and risk of re-injury or complications. It can also be the wrong choice if it closes the door on benefits you will need later. Before accepting this type of settlement, you should clearly understand:

- What benefits you are giving up

- Whether the settlement covers realistic future costs

- How the decision affects your financial and medical future

Contact a Workers’ Compensation Lawyer

A lump-sum settlement may offer certainty and immediate financial relief, yet it also permanently closes the door on future wage benefits and medical care tied to your injury. A workers’ compensation lawyer from Bader Law Injury Lawyers can help determine whether this is the best outcome for your claim and, if not, advocate for a better one.

Schedule a free consultation to discuss your case with an attorney.

Call or text (404) 888-8888 or complete a Free Case Evaluation form