According to the Internal Revenue Service (IRS), workers’ compensation benefits are generally not taxable at the federal or state level. This payout remains tax-free for the duration that the worker receives them. One exception to this rule includes when the worker gets both workers’ compensation payment and disability benefits. In this case, a portion of their benefits is taxable.

When an employee gets hurt while performing assigned duties, workers’ compensation payment can cover their medical bills, prescriptions, and rehab expenses arising from the injuries. If you have questions regarding the workers’ comp process or the related tax laws, you might benefit from speaking with a workers’ compensation attorney in Georgia.

What Does the IRS Say About Workers’ Compensation Benefits?

IRS rules spell out that you generally do not pay taxes on your workers’ compensation benefits. For example, IRS Code 26 U.S. Code § 104 explicitly states the federal government does not consider “amounts received under workmen’s compensation acts as payment for personal injuries or sickness” as income.

So, if you get weekly workers’ compensation payments, you will not have to report the amount at the end of the tax year. In addition, because Georgia follows federal income tax laws, the state will not tax your benefits. Finally, this rule also applies to survivors of a worker who died from an occupational injury or illness.

For a free legal consultation, call (404) 888-8888

When Are Workers’ Compensation Payments Taxed?

There are some instances where workers’ compensation payment may be taxed. These exceptions include the following:

- A portion of your worker’s comp payout might be taxed if you receive Social Security Disability Insurance (SSDI) or Social Security Insurance (SSI) along with your workers’ compensation benefits.

- If the total amount you receive after combining SSDI or SSI benefits with your workers’ compensation exceeds a certain threshold, you’d have to pay taxes on the excess amount.

- If your doctors clear you to return to work after becoming eligible for workers’ compensation, any income you make for performing light duties will be taxable as regular wages.

- Finally, if you receive any interest payment as part of your workers’ compensation claim, the interest payment will be taxable.

What Percentage Does Workers’ Compensation Pay in Georgia?

If you miss work due to a work-related illness or injury for at least seven days, you will receive weekly supplemental income amounting to two-thirds of your regular weekly wages. The maximum you can receive is $725 per week for up to 400 weeks unless you have suffered a catastrophic injury, which could make you eligible for lifetime benefits.

Note that you will not receive compensation for the first seven days you missed work unless you cannot work for 21 consecutive days following your injury, in which case you will get paid for the first seven days.

Sometimes, even after recovery, you cannot do the same job. If so, one of the following compensation structures may apply.

Temporary Partial Disability Payments

If doctors clear you to work again but at a lower-paying position, you could receive temporary partial disability benefits. These payments are based on two-thirds of the difference between your income before and after the occupational injury. In 2022, you can receive up to $483 per week for a maximum of 350 weeks.

Permanent Partial Disability Payments

Once you have achieved maximum medical recovery, if the physician still states that you have a disability, you might qualify for additional benefits through permanent partial disability payment. This structure applies to cases where the injured worker has lost a body part or function.

Under permanent partial disability, you will receive two-thirds of your regular weekly income for a specific duration depending on the type of disability you have.

Permanent Total Disability Payments

If you’ve lost more than one major body part in the occupational injury, you could qualify for permanent total disability benefits.

Lump-sum Payment

Once you receive weekly payments for at least 26 weeks, the Georgia State Board of Workers’ Compensation may allow you to obtain compensation in a lump-sum settlement. This arrangement could be more helpful than weekly payments for those requiring long-term or permanent assistance.

Complete a Free Case Evaluation form now

Schedule a Free Consultation With Our Georgia Workers’ Compensation Attorney

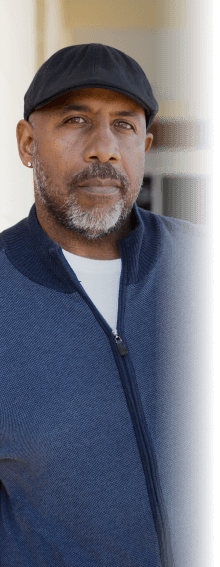

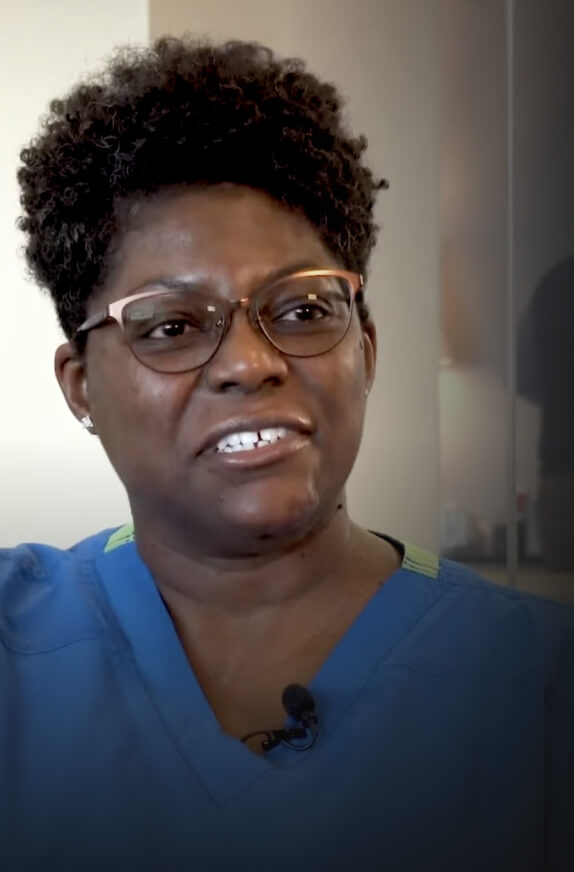

If you or a loved one is injured at work and seeks compensation through a workers’ compensation claim, our team at Bader Law Injury Lawyers is here to provide the legal assistance you need.

Workers’ compensation laws are challenging to navigate by yourself. However, our team has years of experience representing injured workers and fighting for fair compensation. So, schedule your free case review today, during which we’ll evaluate your case and explain your next best steps.

Call or text (404) 888-8888 or complete a Free Case Evaluation form